Latest

- All

- Barack Hussein Obama

- Conservatism

- Donald Trump

- Economy

- Education

- Election News

- Email Featured

- Featured

- flagandcross

- Government Gone Wild

- Gun Control

- Healthcare

- Hillary Clinton

- Immigration

- Iran

- Islam/Sharia Issues

- Israel

- Liberals

- Mainstream Media

- National Security

- Opinion

- Politics

- Religion 1st Amendment

- Social Issues

- Socialism

- Veterans/Military

- Worldwide Events

-

Great American RepublicApril 2, 2021

Black Teen Girls Who Murdered Uber Driver In DC Carjacking Will Receive Plea Deal (Details)

The following article, Black Teen Girls Who Murdered Uber Driver In DC Carjacking Will Receive Plea Deal (Details), was first…

Read More » -

Great American RepublicApril 2, 2021

GOP Governor DeSantis Takes A Stand, Bans ‘Vaccine Passport’ via Executive Order

The following article, GOP Governor DeSantis Takes A Stand, Bans ‘Vaccine Passport’ via Executive Order, was first published on Flag…

Read More » -

Great American RepublicApril 2, 2021

Trump Releases ‘Happy Easter’ Statement, Slams ‘Fake News Media’ Over ‘Election Fraud’

The following article, Trump Releases ‘Happy Easter’ Statement, Slams ‘Fake News Media’ Over ‘Election Fraud’, was first published on Flag…

Read More » -

Great American RepublicApril 2, 2021

Baseball Caves to ‘Woke’ Cancel Culture Crowd, Will Move All-Star Game Out of Atlanta

The following article, Baseball Caves to ‘Woke’ Cancel Culture Crowd, Will Move All-Star Game Out of Atlanta, was first published…

Read More » -

Great American RepublicApril 2, 2021

Hunter Biden Admits Laptop ‘Could Be’ His, But MSM Said It Was GOP Smear Campaign

The following article, Hunter Biden Admits Laptop ‘Could Be’ His, But MSM Said It Was GOP Smear Campaign, was first…

Read More » -

Great American RepublicApril 2, 2021

Capitol Building Killer Is Nation of Islam Follower, But Asian Doctor Says It Is Trump’s Fault

The following article, Capitol Building Killer Is Nation of Islam Follower, But Asian Doctor Says It Is Trump’s Fault, was…

Read More » -

Great American RepublicApril 2, 2021

Joe Biden Set to Seriously Look Into Canceling Student Debt (Details)

The following article, Joe Biden Set to Seriously Look Into Canceling Student Debt (Details), was first published on Flag And…

Read More » -

flagandcross

Great American RepublicApril 2, 2021

Great American RepublicApril 2, 2021Flashback: Biden Says Drunk Driving Not A Felony for Undocumented, Won’t Deport For It

The following article, Flashback: Biden Says Drunk Driving Not A Felony for Undocumented, Won’t Deport For It, was first published…

Read More » -

Great American RepublicApril 2, 2021

ICYMI: Migrant Kids Getting In-Person Schooling In San Diego, US Students Stuck Online

The following article, ICYMI: Migrant Kids Getting In-Person Schooling In San Diego, US Students Stuck Online, was first published on…

Read More » -

Great American RepublicApril 2, 2021

‘Last Thing the Economy Needs Right Now’ – McConnell Responds to Joe’s Historic Tax Proposal

The following article, ‘Last Thing the Economy Needs Right Now’ – McConnell Responds to Joe’s Historic Tax Proposal, was first…

Read More » -

Great American RepublicApril 2, 2021

Report: COVID-19 Is On the Rise Once Again

The following article, Report: COVID-19 Is On the Rise Once Again, was first published on Flag And Cross. Here we…

Read More » -

Great American RepublicApril 2, 2021

Biden Makes Baseball’s Opening Day Political, Calls on MLB to Cancel Atlanta All-Star Game

The following article, Biden Makes Baseball’s Opening Day Political, Calls on MLB to Cancel Atlanta All-Star Game, was first published…

Read More » -

Great American RepublicApril 2, 2021

Cancel Culture Falsely Attacks Voter ID Bills | Schaftlein Report

The following article, Cancel Culture Falsely Attacks Voter ID Bills | Schaftlein Report, was first published on Flag And Cross.…

Read More » -

Great American RepublicApril 2, 2021

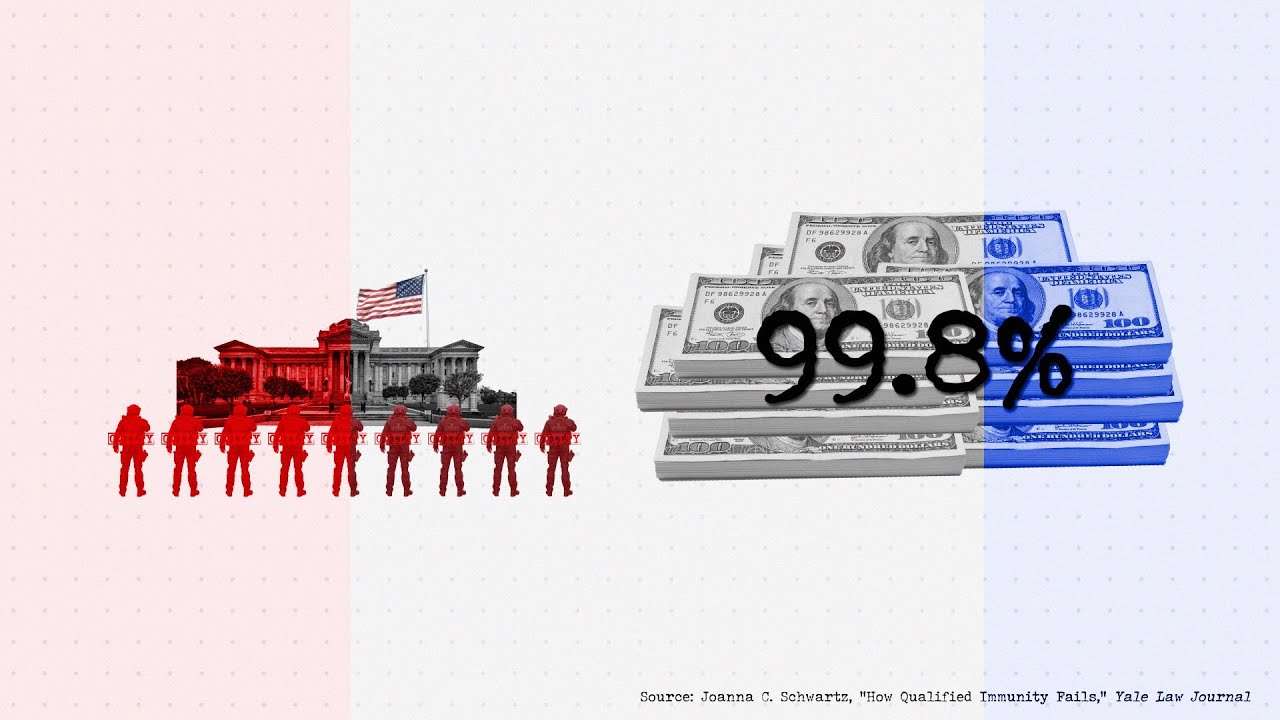

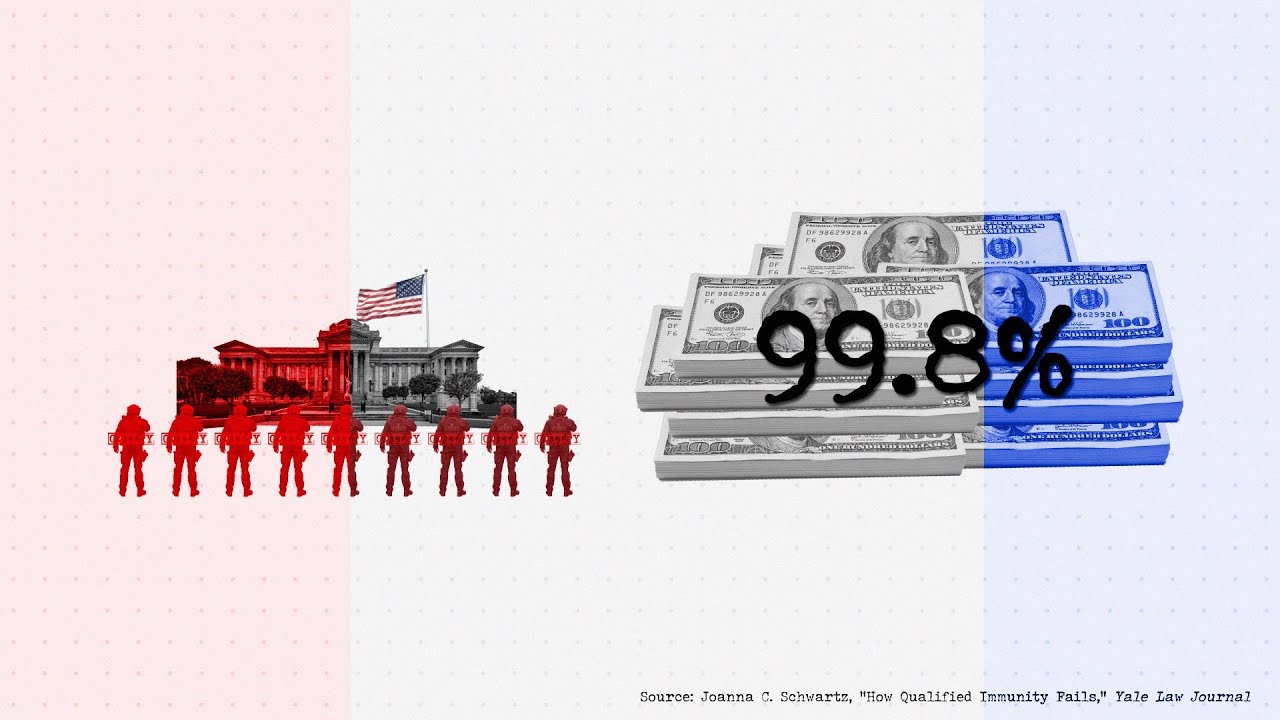

Flashback: Black Lives Matter Wants Biden to Begin ‘Roadmap’ Toward Abolishing Prisons, Cops

The following article, Flashback: Black Lives Matter Wants Biden to Begin ‘Roadmap’ Toward Abolishing Prisons, Cops, was first published on…

Read More » -

Great American RepublicApril 2, 2021

ICYMI: Team Biden Developing Covid Passport for People to Show Proof of Vaccination

The following article, ICYMI: Team Biden Developing Covid Passport for People to Show Proof of Vaccination, was first published on…

Read More » -

flagandcross

Great American RepublicApril 2, 2021

Great American RepublicApril 2, 2021VIDEO: Ben Shapiro Slams Joe Biden for Ruining Sports, Rips Jill Biden for Spanish Flub

The following article, VIDEO: Ben Shapiro Slams Joe Biden for Ruining Sports, Rips Jill Biden for Spanish Flub, was first…

Read More » -

flagandcross

Great American RepublicApril 1, 2021

Great American RepublicApril 1, 2021‘Cruel & Heartless Attack on the American Dream’ – Trump Rips Joe for Demanding Tax Hike

The following article, ‘Cruel & Heartless Attack on the American Dream’ – Trump Rips Joe for Demanding Tax Hike, was…

Read More » -

flagandcross

Great American RepublicApril 1, 2021

Great American RepublicApril 1, 2021‘Cruel & Heartless Attack on the American Dream’ – Trump Rips Joe for Demanding Tax Hike

The following article, ‘Cruel & Heartless Attack on the American Dream’ – Trump Rips Joe for Demanding Tax Hike, was…

Read More » -

Great American RepublicApril 1, 2021

GOP-Controlled Arizona Senate Hires Auditor to Review Maricopa County Election Results

The following article, GOP-Controlled Arizona Senate Hires Auditor to Review Maricopa County Election Results, was first published on Flag And…

Read More » -

Great American RepublicApril 1, 2021

GOP-Controlled Arizona Senate Hires Auditor to Review Maricopa County Election Results

The following article, GOP-Controlled Arizona Senate Hires Auditor to Review Maricopa County Election Results, was first published on Flag And…

Read More »